What is gap insurance | Types of gap insurance

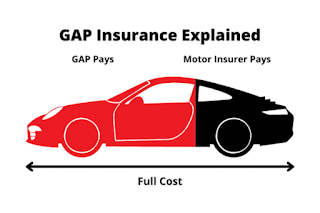

Gap insurance, also known as guaranteed asset protection insurance, is a type of insurance coverage that helps protect you financially if your vehicle is totaled or stolen and the insurance payout is less than the amount you owe on your car loan or lease.

When you purchase a new vehicle, its value starts depreciating as

soon as you drive it off the lot. If your vehicle gets stolen or is

involved in an accident, your insurance company typically pays you the

current market value of the car at the time of the incident.

However,

if you have a car loan or lease, the amount you owe may be higher than

the insurance payout, leaving you responsible for the remaining balance.

This is where gap insurance comes into play. Gap insurance covers the

difference, or the "gap," between the amount you owe on your loan or

lease and the actual cash value of your vehicle.

|

| gap insurance |

It

ensures that you won't be left paying off a loan or lease for a vehicle

that you no longer have. Gap insurance is usually offered as an

additional coverage option when you purchase or lease a vehicle. It can

be obtained from various sources, including car dealerships, insurance

companies, and financial institutions.

The cost

of gap insurance varies depending on the provider and the value of your

vehicle. It's worth noting that gap insurance typically only covers the

outstanding balance on your loan or lease and doesn't provide coverage

for other expenses like deductibles, extended warranties, or past-due

payments.

It's essential to review the terms

and conditions of your gap insurance policy to understand what is

covered and any limitations or exclusions. If you're considering

purchasing gap insurance, it's recommended to compare quotes from

different providers and understand the coverage options available to

make an informed decision.

Additionally, it's

always a good idea to consult with an insurance professional or

financial advisor who can provide personalized guidance based on your

specific situation.

What is gap insurance?

Gap insurance, also known as guaranteed asset protection insurance, is a type of insurance coverage that helps protect you financially in the event that your vehicle is totaled or stolen. It covers the "gap" between the amount you owe on your auto loan or lease and the actual cash value of your vehicle as determined by your primary auto insurance.When you purchase a new vehicle, its value depreciates quickly. If

your car is involved in an accident or stolen, your primary auto

insurance typically pays you the current market value of the vehicle at

the time of the incident. However, this amount may be lower than the

outstanding balance on your loan or lease.

In such situations, gap insurance kicks in. It covers the

difference between the insurance payout and the remaining amount on your

loan or lease. This ensures that you're not left with a significant

financial burden of having to pay for a vehicle you no longer have.

Here's an example to illustrate how gap insurance works:

Let's say you bought a car for $30,000, and after a few months, it

gets totaled in an accident. At the time of the accident, the current

market value of the car is determined to be $25,000. However, you still

owe $28,000 on your auto loan.

In this

scenario, your primary auto insurance will pay you $25,000, but you'll

be responsible for paying the remaining $3,000 out of pocket. If you

have gap insurance, it will cover the $3,000, effectively closing the

gap between the insurance payout and the remaining loan amount. Gap

insurance is commonly offered by car dealerships, insurance companies,

and financial institutions.

The cost of gap

insurance can vary depending on factors such as the provider, the value

of your vehicle, and the length of coverage. It's important to note that

gap insurance is primarily designed for new vehicles or vehicles with

high depreciation rates. If you have an older vehicle or have already

paid off a significant portion of your loan, gap insurance may not be

necessary.

It's always recommended to

carefully evaluate your specific circumstances and consult with an

insurance professional to determine if gap insurance is right for you.

Types of gap insurance?

There are primarily three types of gap insurance coverage:1. Finance Gap Insurance

This

is the most common type of gap insurance and is designed for

individuals who have financed their vehicle through a loan. Finance gap

insurance covers the difference between the outstanding balance on your

auto loan and the actual cash value of your vehicle.

If

your car is declared a total loss or is stolen, the insurance will

bridge the gap, ensuring you're not left with a debt to repay.

2. Lease Gap Insurance

Lease

gap insurance is specifically tailored for individuals who are leasing a

vehicle rather than financing it. Since leasing contracts often have

different terms and conditions than loans, lease gap insurance covers

the difference between the remaining lease payments and the actual cash

value of the vehicle.

In the event of a total loss or theft, the insurance will cover the outstanding lease balance.

3. New Car Gap Insurance

New

car gap insurance is designed for individuals who have purchased a

brand-new vehicle. As new cars tend to experience rapid depreciation in

their initial years, this coverage ensures that the gap between the

original purchase price and the actual cash value is covered.

If

your new car is totaled or stolen, the insurance will bridge the gap,

allowing you to recover the amount you initially paid for the vehicle.

It's important to note that the availability of these gap insurance

types may vary depending on the insurance provider or institution

offering the coverage.

Some providers may

offer additional variations or customization options within these types

of coverage. When considering gap insurance, it's advisable to carefully

review the terms and conditions of the policy, including any

limitations or exclusions.

This will help you understand what is covered and make an informed decision based on your specific situation and needs.

Is gap insurance worth it?

Whether or not gap insurance is worth it depends on your individual circumstances and preferences. Here are some factors to consider when deciding if gap insurance is right for you:1. Loan or Lease Terms

If

you have a car loan or lease with a high-interest rate or long

repayment period, the depreciation of your vehicle may outpace the rate

at which you're paying down the loan or lease.

This

means that the gap between the outstanding balance and the actual cash

value of your vehicle could be significant. In such cases, gap insurance

can provide valuable financial protection.

2. Down Payment and Depreciation

If

you made a small down payment on your vehicle or no down payment at

all, you may be more susceptible to owing more on your loan or lease

than the actual value of the vehicle.

Additionally, certain types of vehicles, such as luxury cars or models that depreciate quickly, may benefit from gap insurance.

3. Financial Stability

Consider

your financial situation and ability to absorb unexpected expenses. If

you don't have enough savings to cover the potential gap between the

insurance payout and your outstanding loan or lease balance, gap

insurance can provide peace of mind and protect you from a financial

burden.

4. Primary Auto Insurance Coverage

Review

your primary auto insurance policy to understand how it determines the

value of a totaled or stolen vehicle. If your policy does not provide

sufficient coverage to fully pay off your loan or lease in the event of a

total loss, gap insurance can be beneficial.

5. Cost and Value of Vehicle

Evaluate

the cost of gap insurance premiums compared to the potential financial

risk. The price of gap insurance varies depending on factors such as the

provider, the value of your vehicle, and the length of coverage.

Consider whether the cost of the coverage outweighs the potential

benefits.

Ultimately, the decision to purchase gap insurance should be based

on a careful evaluation of your specific circumstances. It's advisable

to research and compare quotes from different providers, review the

terms and conditions of the policies, and consult with an insurance

professional who can provide personalized guidance based on your

situation.

What is auto gap insurance?

Auto gap insurance, also known as car gap insurance or simply gap insurance, is a specific type of gap insurance that covers the "gap" between the amount owed on an auto loan or lease and the actual cash value of the vehicle in the event of a total loss or theft.When you purchase a vehicle, its value starts depreciating

immediately. If your car is involved in an accident and deemed a total

loss, or if it is stolen and not recovered, your primary auto insurance

company typically pays you the actual cash value of the vehicle at the

time of the incident.

However, this amount may

be less than the outstanding balance on your auto loan or lease. Auto

gap insurance steps in to cover this difference. It ensures that you are

not left responsible for paying off a loan or lease for a vehicle that

is no longer in your possession.

Gap insurance

protects you from potential financial hardship in such situations by

bridging the gap between the insurance payout and the amount you still

owe on your auto loan or lease.

Auto gap insurance is particularly relevant for individuals who

have purchased a new vehicle or have leased a car. This is because new

vehicles tend to depreciate quickly, and lease agreements often have

specific terms regarding vehicle value and return conditions.

It's important to note that auto gap insurance is usually an

optional coverage that can be purchased in addition to your primary auto

insurance policy. It is typically offered by car dealerships, insurance

companies, and sometimes by financial institutions. The cost of auto

gap insurance can vary depending on factors such as the value of the

vehicle and the length of coverage.

Before purchasing auto gap insurance, it's recommended to carefully

review the terms and conditions of the policy, compare quotes from

different providers, and consider your specific circumstances to

determine if the coverage is necessary and beneficial for you.

What is gap insurance for cars?

Gap insurance for cars, also known as auto gap insurance or vehicle gap insurance, is a type of insurance coverage designed to protect car owners from the potential financial loss that can occur if their vehicle is declared a total loss or stolen.When you purchase a car, its value starts to depreciate

immediately. If your car is involved in an accident and deemed a total

loss by your primary auto insurance company or if it is stolen and not

recovered, your insurer will typically provide a payout based on the

actual cash value (ACV) of the vehicle at the time of the incident.

|

| gap insurance |

However,

this ACV might be significantly lower than the amount you still owe on

your car loan or lease. Gap insurance for cars helps bridge this gap

between the insurance payout and the remaining balance on your loan or

lease. It covers the difference, ensuring that you are not left

responsible for paying off a loan or lease for a vehicle that you no

longer possess.

Here's an example to illustrate how gap insurance for cars works:

Let's say you purchased a car for $30,000, and after a few months,

it is involved in a severe accident that renders it a total loss. At the

time of the accident, the ACV of the car is determined to be $25,000.

However,

you still owe $28,000 on your car loan. In this scenario, your primary

auto insurance will pay you $25,000, but you would be left with a

remaining balance of $3,000 on your loan. If you have gap insurance for

cars, it would cover the $3,000 difference, ensuring that your loan is

fully paid off despite the insurance payout falling short.

Read More.....

Gap insurance for cars is typically offered as optional coverage

when you purchase or lease a vehicle. It can be obtained from various

sources, including car dealerships, insurance companies, and financial

institutions. The cost of gap insurance varies depending on the

provider, the value of your vehicle, and the length of coverage.

Before purchasing gap insurance for cars, it's important to review

the terms and conditions of the policy, consider your specific

circumstances, and compare quotes from different providers. This will

help you make an informed decision about whether the coverage is

necessary and beneficial for you.

How to cancel gap insurance?

To cancel gap insurance, you generally need to follow these steps:1. Review the Policy

Carefully

review your gap insurance policy to understand the terms and

conditions, including the cancellation policy. Look for information on

how to cancel, any applicable fees or penalties, and the timeframe

within which you can request cancellation.

2. Contact the Provider

Reach

out to the insurance provider or institution from which you purchased

the gap insurance. Obtain their contact information from your policy

documents or their website. It's usually best to contact them by phone

to ensure prompt communication.

3. Provide Policy Details

When

you speak with a representative, provide your policy details, such as

the policy number and your personal information, to help them locate

your policy in their system.

4. Request Cancellation

Clearly

state your intention to cancel the gap insurance policy. Follow any

specific instructions provided by the representative, such as submitting

a written request or completing a cancellation form.

Be prepared to explain your reasons for canceling, although it is typically not required.

5. Verify Refund or Cancellation Terms

Ask

about the refund or cancellation terms and any potential fees involved.

The representative should provide information on whether you are

eligible for a partial or full refund and when you can expect to receive

it.

6. Submit Documentation (if required)

Some

insurance providers may require you to submit supporting documentation,

such as a copy of your primary auto insurance policy or a statement

indicating that the loan or lease has been paid off. Follow the

instructions provided by the representative regarding any necessary

documentation.

7. Follow-Up

After

canceling, follow up with the insurance provider to ensure that the

cancellation has been processed correctly and to verify the status of

your refund, if applicable.

It's important to note that the specific cancellation process may

vary depending on the insurance provider and the terms of your policy.

Some providers may have specific cancellation forms or procedures, so

it's essential to follow their instructions closely.

If you have any concerns or questions during the cancellation

process, don't hesitate to ask the insurance provider for clarification

or assistance.

Advantages and disadvantages of gap insurance?

Gap insurance offers several advantages and disadvantages that are important to consider:Advantages of Gap Insurance:

1. Financial Protection

The

primary advantage of gap insurance is that it provides financial

protection in case of a total loss or theft of your vehicle. It covers

the difference between the actual cash value of the vehicle and the

remaining balance on your loan or lease. This ensures that you are not

left with the significant financial burden of paying off a loan or lease

for a vehicle you no longer have.

2. Peace of Mind

Gap

insurance provides peace of mind knowing that you are protected from

potential financial hardship. It can help alleviate the stress and worry

associated with being responsible for a substantial gap between the

insurance payout and your outstanding loan or lease balance.

3. Coverage for High Depreciation

Gap

insurance is particularly beneficial for new vehicles or vehicles with

high depreciation rates. These vehicles can experience a significant

drop in value soon after purchase, which may result in a substantial gap

between the loan/lease balance and the vehicle's actual cash value.

Disadvantages of Gap Insurance:

1. Cost

Gap

insurance comes at an additional cost, adding to your overall insurance

expenses. The price of gap insurance varies depending on factors such

as the value of your vehicle, the length of coverage, and the provider.

It's important to weigh the cost against the potential benefits and your specific circumstances.

2. Limited Coverage

Gap

insurance typically covers only the difference between the loan/lease

balance and the actual cash value of the vehicle. It may not cover other

expenses, such as deductibles, extended warranties, or past-due

payments.

Make sure to review the terms and conditions of your policy to understand the coverage limitations and exclusions.

3. Necessity and Duration

Gap

insurance may not be necessary for everyone. If you have made a

significant down payment, have a short loan/lease term, or own a vehicle

that retains its value well, the gap between the loan/lease balance and

the actual cash value may be minimal.

Additionally,

as you make payments over time, the gap between the outstanding balance

and the vehicle's value decreases, making gap insurance less necessary

as the loan/lease is paid down.

It's important to assess your individual circumstances, including

the value of your vehicle, your loan/lease terms, and your financial

stability, to determine if the advantages of gap insurance outweigh the

potential disadvantages.

Consider comparing quotes from different providers and consulting with an insurance professional for personalized guidance.